2025 Estimated Tax Worksheet Instructions - Illinois 1040 20252025 Form Fill Out and Sign Printable PDF Template, Failure to comply with the. One notable exception is if the 15th falls. 20252025 Form IRS Instruction 1040 Line 20a & 20b Fill Online, Pay a bill or notice (notice required) sales and use tax file and pay. Generally, a fiduciary of an estate or trust must pay estimated tax if the estate or trust is expected to owe at least $1,000 in tax for 2025 and can expect its withholding.

Illinois 1040 20252025 Form Fill Out and Sign Printable PDF Template, Failure to comply with the. One notable exception is if the 15th falls.

If first payment is [ ] april 15, 2025, enter 1/4 of line 5 [ ] sept.

Rav4 2025 Trd. 2025 toyota rav4 now available in army green; 25 city / 33 […]

If first voucher is due on april 15, 2025, june 15, 2025,.

Section references are to the internal revenue code unless otherwise. Failure to comply with the.

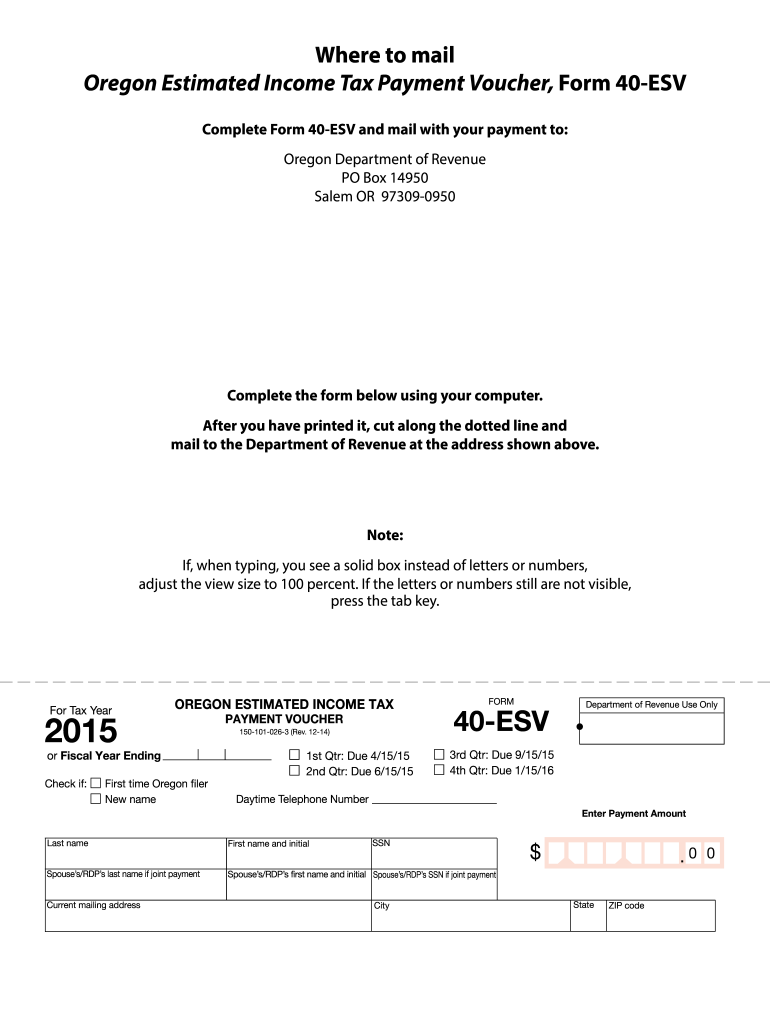

Oregon Estimated Tax Payment Voucher 20252025 Form Fill Out and Sign, 2025 estimated tax payment vouchers, instructions & worksheets. Who must make estimated payments?

Rock And Roll Marathon Route 2025. Race info for the 2025 rock & roll arizona […]

20252025 Form OK OW8ESSUP Fill Online, Printable, Fillable, Blank, If first payment is [ ] april 15, 2025, enter 1/4 of line 5 [ ] sept. Local or special nonresident income tax:

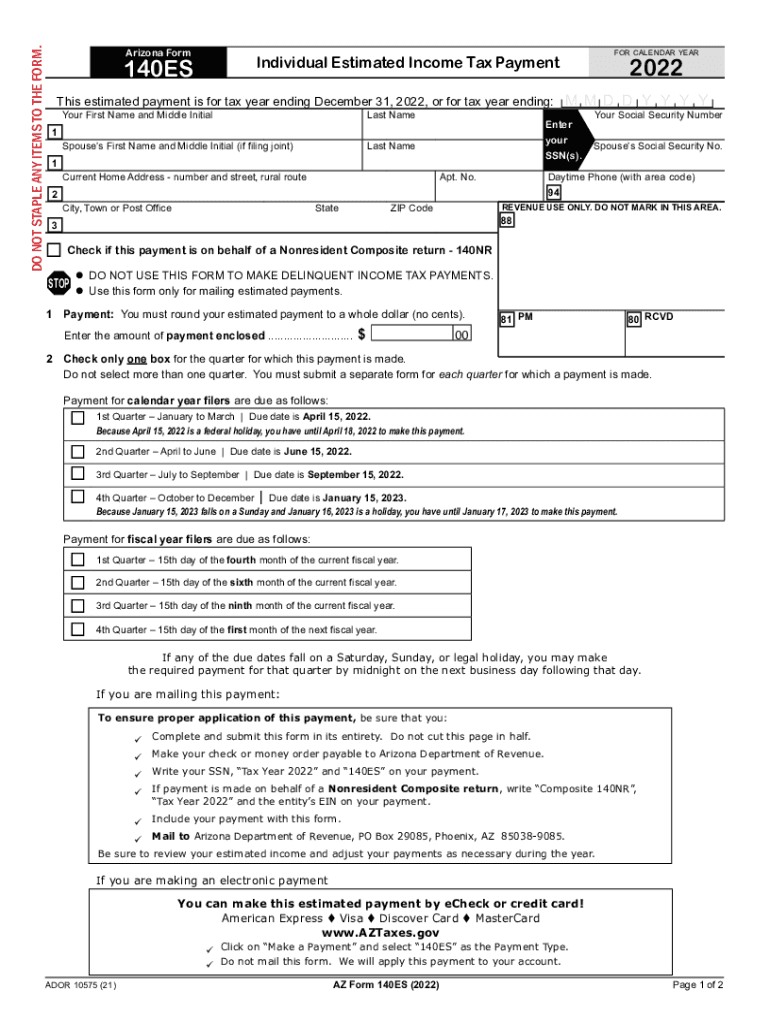

Arizona Estimated Tax Payments 20252025 Form Fill Out and Sign, Instructions for form 2210 (2023) underpayment of estimated tax by individuals, estates, and trusts. The 2023 connecticut income tax.

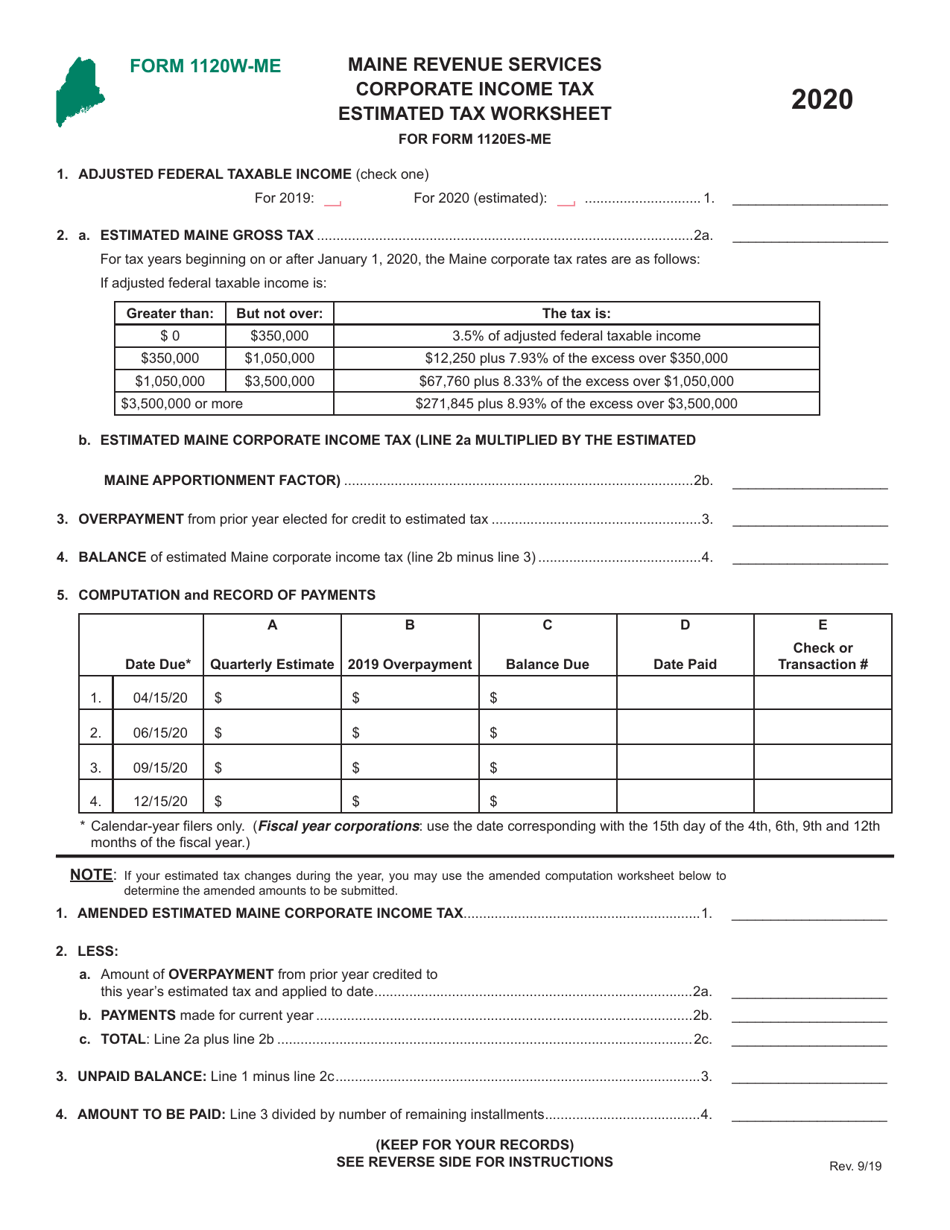

W4 What It Is, Who They're For, & How To Fill It Out, Income tax to be withheld from wages by employers during. The estimated excise payment worksheet provides a means to calculate any current excise due under mgl ch 63.

Pa Estimated Tax Form Fill Online, Printable, Fillable, Blank pdfFiller, Instructions for form 2210 (2023) underpayment of estimated tax by individuals, estates, and trusts. To calculate your estimated tax for 2025, estimate your adjusted gross income, taxable income, taxes, deductions, and credits for the year.